The Burden of Increased Debt Stock: Implication on the Economic Stability and Growth

Nigeria, Africa’s most populous country and the largest economy is facing a debt burden that has been increasing steadily in recent years. With declining oil revenue, the country’s main source of foreign exchange, the government has been borrowing heavily to fund its budget, leading to a worrying debt-to-GDP ratio and an even troubling debt-to-revenue ratio. The incoming government, led by Bola Ahmed Tinubu, will have to grapple with this issue, as the country’s economic stability and growth prospects are threatened.

Nigeria’s debt burden has been a major challenge for the outgoing government led by President Mohammadu Buhari as it accumulated a total of $12.56 trillion in seven years with very little development to show for it. Deficit financing has risen by 402% from N2.41 trillion in 2016 to N12.1% in 2023. For a government which piggy-backed on its promise to tackle the monster of corruption sequel to its ascension to power, it is a big disappointment, therefore that the country has slipped further in the world corruption perception index. This slip is judged by many as a total failure of the administration of Buhari.

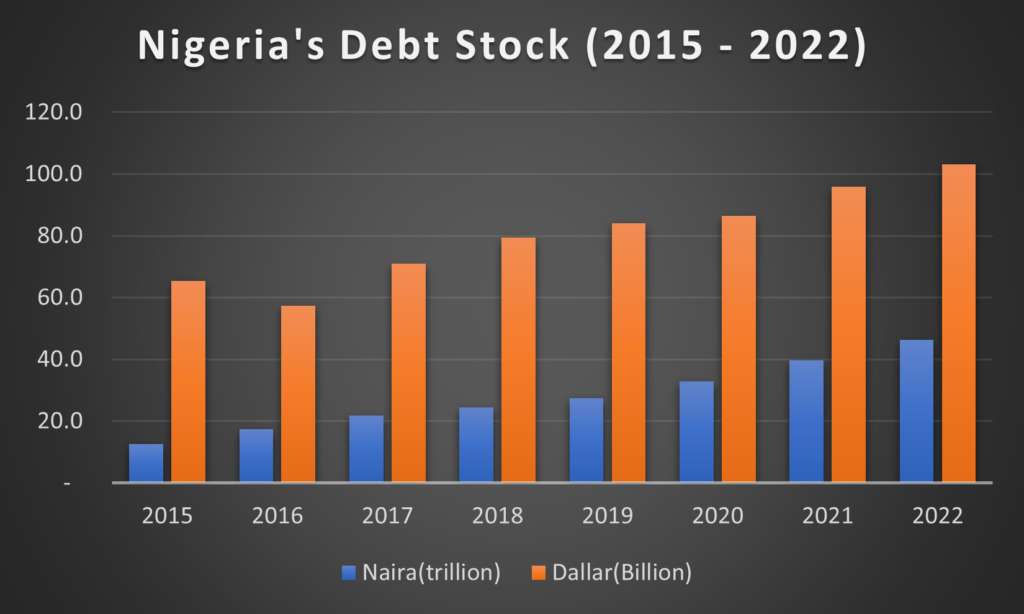

The current debt situation in Nigeria is alarming, as the country’s total public debt stock stood at N46.25trn as of December 2022, according to the Debt Management Office (DMO). This figure is an increase of N6.694 trillion year on year representing a 15% increase and 5% from the N44.06 trillion in just three months. The bulk of Nigeria’s debts is owed to multilateral institutions such as the World Bank, African Development Bank (AfDB), and International Monetary Fund (IMF), which account for over 50% of the debt stock. The rest is owed to bilateral lenders such as China, France, and Japan, as well as commercial banks and Eurobonds.

The debt burden has become a pressing issue for Nigeria, given the increasing cost of servicing it. According to the DMO, Nigeria spent over N3.63 trillion ($4.5 billion) in debt servicing in 2022, which is about 68% of the capital expenditure (infrastructural development). A breakdown shows total domestic debt stock stands at N27.55 trillion (61.42 billion USD), while the entire external debt stock was N18.70 trillion (USD 41.69 billion).

The debt burden has far-reaching implications for Nigeria’s economy and its citizens. The increasing debt servicing cost means that there will be less money available for public spending, including social services such as education, health, and infrastructure. This will have a negative impact on the quality of life of Nigerians, as the government will have to make tough choices on what projects to prioritize.

There is also the risk of Nigeria’s debt becoming unsustainable, as the country’s debt-to-GDP ratio has been increasing rapidly. According to the World Bank, Nigeria’s debt to GDP ratio stood at 22.0% in 2011 but had risen to 23.2% by 2022 coming down from a rise of 34.6% in 2019.

The debt burden also puts Nigeria at risk of debt distress, which would make it difficult for the country to access new loans, as lenders become cautious about Nigeria’s ability to repay its debts. The IMF has already raised concerns about Nigeria’s rising debt levels and has urged the government to adopt a more prudent borrowing approach. This is because borrowing, when not properly managed, can lead to a debt trap, where the country finds it difficult to repay its debts and is forced to borrow more to service existing debts.

New governments are billed to take over at the federal level and in 28 states of Nigeria on May 29, 2023, and the responsibility of charting a way forward for more sustainable revenue generation mechanisms is a huge one the president and state governors would have to shoulder.

The new government needs to improve its debt management framework to ensure that borrowed funds are used only for productive projects and that debt servicing costs are kept at a sustainable level. But rather than resort to more borrowings to bridge the enormous yawning infrastructural gaps, the government need to think out of the box to diversify its revenue sources and reduce its expenditure, especially on non-essential projects. With a budget already running at 57% deficit, the recurring problems of the overdependence on crude oil for its foreign exchange and the weak value of the naira against other international currencies, the new government is already faced with a huge fiscal mountain to climb. The country needs more funds than it currently generates to fund its budget, which is still inadequate to drive economic growth and stir the nation into positive social development.

The new government also needs to address the issue of corruption, which has been a major factor contributing to Nigeria’s debt burden. Corruption has led to the mismanagement of funds, resulting in inflated contracts, uncompleted projects, and embezzlement of public funds. This has been one of the major contributors to Nigeria’s rising debt, as the government has had to borrow more to fund projects that have not yielded any results. Other measures the new government can employ include

Diversify the economy: Nigeria’s economy is mostly reliant on oil exports and is thus susceptible to changes in oil prices. The government must promote diversification by making investments in other industries including manufacturing, agriculture, and technology.

Reduce wasteful spending: By eliminating unused costs and enhancing the effectiveness of public expenditures, the government may eliminate wasteful spending. The cost of funding the high, opulent and frivolous lifestyles of political office holders at the executive and legislative arms of government has been a huge burden on the scarce resources of the country to the detriment of the general citizen who lives on an income of less than a dollar per day.

Improve public sector governance: Reducing corruption and enhancing openness, inclusiveness and accountability are three ways the government may strengthen public sector governance.

Manage debt effectively: The government can manage debt effectively by prioritizing debt repayment and avoiding excessive borrowing.

Implement structural reforms: The government can implement structural reforms to improve the efficiency and competitiveness of the economy. Examples include improving infrastructure, deregulating key sectors, and improving the ease of doing business.

Failing to implement these actions will result in more borrowings by the incoming administration to implement the 2023 and subsequent years’ appropriation. This will plunge further the nation into more debt which will have devastating effects on Nigeria’s economic stability, development prospects, and citizens’ quality of life.