By Jonathan Are, Communications Assistant

There has been a massive outcry over the increasing rate of borrowing by the Nigerian government. The Nigerian public debt profile rose significantly between 2015 and 2017. As at June 30, 2015, Nigeria public debt stock was N12.12tr. However, as at December 2017, the debt had increased by over 72% to N21.7trn, a difference of N8.25trn in two years. It is important to note that this amount is more than the entire budget allocation for 2018. Similarly, Nigeria’s spending on debt servicing in the same period climaxed at 34.02% of the nation’s revenue.

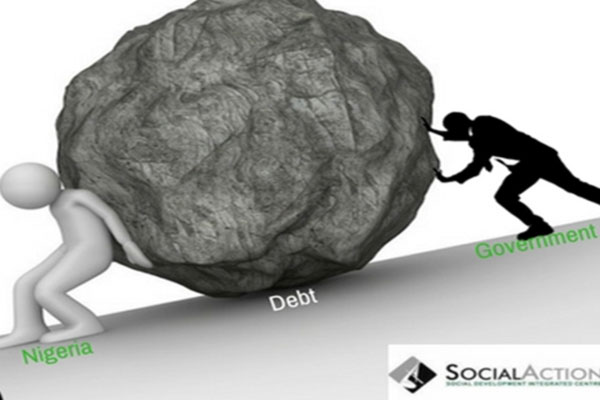

In a country of over 180 million populations in which more than half of the population lives in abject poverty, a public debt of this magnitude imposes added burdens on citizens. With the increasing rate of unemployment and the deplorable state of infrastructure, the impact of debt accumulations becomes a thing of concern.

Rather than debt translating to concrete benefits to the citizens, it has become a burden on the citizens as more monies that should be used for development projects are used to service debts, looted by the elites and wasted on gratuitous expenditures and senseless allocations for which no significant benefit can be traced to the general public.

The federal government has continued to amass debt from both local and foreign sources. In January 2018 alone, Nigerian government issued an N110 billion bond via bond auction and an additional N385 billion via local bonds. Meanwhile, the government also planned to raise $700m from multilateral sources as part of the $3.5bn in the 2017 borrowing plan. Furthermore, as part of its strategic move to offset the domestic debt, a loan of 2.5 billion dollars was also planned to refinance domestic debt. This implies that the federal government seems not to be relenting in its pursuit of debts despite the fact that this act of borrowing has been flagged as unsustainable even by experts.

Social Action has always been at the forefront of the campaign against debt accumulation, hammering on the cost and effect of the unfettered borrowing by the federal and state governments while calling the attention of all to the need for a moratorium. Social Action in an Advocacy Brief entitled Whose Burden? Examining the Growing Public Debt Crisis in Nigeria published in 2015 expressed concerns as to the ‘desirability, necessity and capacity of government to manage Nigeria’s proposed loans and the rising debt stock’. The publication highlighted grey areas surrounding Nigerian borrowing pattern, and the appalling unaccountability in the use of such loans. The Nigerian government has failed to yield to this critical call, leaving debt servicing to continue to rob the country of the benefits that annual budgets ought to bring to the citizens.

More than ever before, the advocacy gong for the drive against public debt in Nigeria now echoes louder on Twitter, Facebook and order online platforms as Social Action and other citizens organisations continue the campaign to warn and alert all of the danger of Nigeria’s rising debt burden. Noteworthy also are the concerns raised by notable experts and international organisations such as the IMF over Nigeria’s excessive reliance on foreign debt.

Some Nigerian lawmakers also expressed similar concerns with members of the National Assembly sometimes raising doubt about the propriety of borrowing, such as the case of the N4.2 trillion Naira bond request by President Buhari in a letter read in the Senate on March 28. This was after an earlier loan request of $200 billion was rejected by the National Assembly due to displeasure over the failure of the federal government to accounts for over N9.2 trillion loans approved in 2016 by the National Assembly.

Most recent is the Senate rejection of Kaduna State government loan request of $350 million from the World Bank. A recent report released by the DMO on states debt stock shows that Kaduna State is the most indebted state in Nigeria after Lagos state, with a total debt stock of $232.1 million. Many Nigerians lauded this move by the Senate as the level of Indebtedness by States in Nigeria is now a call for concern.

While borrowing can aid economic recovery if judiciously utilised, economy analysts believed that greater reliance on foreign borrowing which may make the economy vulnerable and further heighten financial risk should be strategically avoided. However, the federal government seems to have been eluded by this fact.

The Federal Government pitches its argument to support the continuous debt accumulation on the grounds that Nigeria’s debt to GDP ratio is below the international threshold of 30%. Does this in any way justify the seemingly unquenchable test for reckless borrowings?

First, it must be stated that debt is being paid from the country’s revenue, not the GDP. Moreover, if according to the DMO, the country’s debt service to revenue ratio was 34.02 percent as of June 30, 2017, and we borrowed N9.18tn in less than a year, then we can rightly conclude that Nigeria is spending on debt servicing is not sustainable. The question is, what have the monies been used for? One may further ask, where are the capital projects? Why is Nigeria still ranked as one of the most impoverished countries in the world? Why are infrastructures in poor states? Why are unemployment and inflation increasing exponentially?

It is worrisome to see some loans tied to capital projects having little or nothing to show for them while some cannot be traced to any executed or current projects. For instance, the $300 million Diaspora bond issued on March 29, 2017, was not tied to a specific project, though government suggested that the loan was for capital projects in priority sectors. Which capital projects? Even when a loan is traced to a specific project, we often see at the completion of the project that the volume of the loans obtained does not commensurate with the value or standard of the project on the ground.

With steady increases in the price of crude oil, it should be reasonably assumed that the government will cut down on debt and work out a sustainable means of reducing the burden of debt serving.

It is given this that Nigerian citizens are demanding that the Federal Government should cut down on borrowing, work out a comprehensive way of reducing the burden of debt servicing so that more money can be made available for capital projects. There should be proper accountability of all borrowed fund while they are tied to significant projects that will serve the interest of the entire citizens. The government should take visible steps to block leakages and cut down on the waste of resources and public funds.